Great Divide Mining Limited (ASX: GDM) today reported significant advancement across all projects during FY25, highlighted by new tenement acquisitions, successful joint ventures, and strengthened investor support.

During the year GDM secured two new tenements at its’ Devils Mountain project, extending gold and copper strike length to 7.5km and consolidating control over historically high-grade ground. The Company also entered into a farm-in with Adelong Gold Ltd at the Challenger Gold Mine, NSW, achieving first gold pour in July 2025 and increasing ownership to 51%.

A joint venture with Dart Mining NL was executed over the Coonambula Project, delivering an immediate $250,000 cash injection and committing Dart to fund 4,000m of drilling and resource definition. Exploration across the broader portfolio also confirmed high-grade antimony and gold results at the Banshee Prospect.

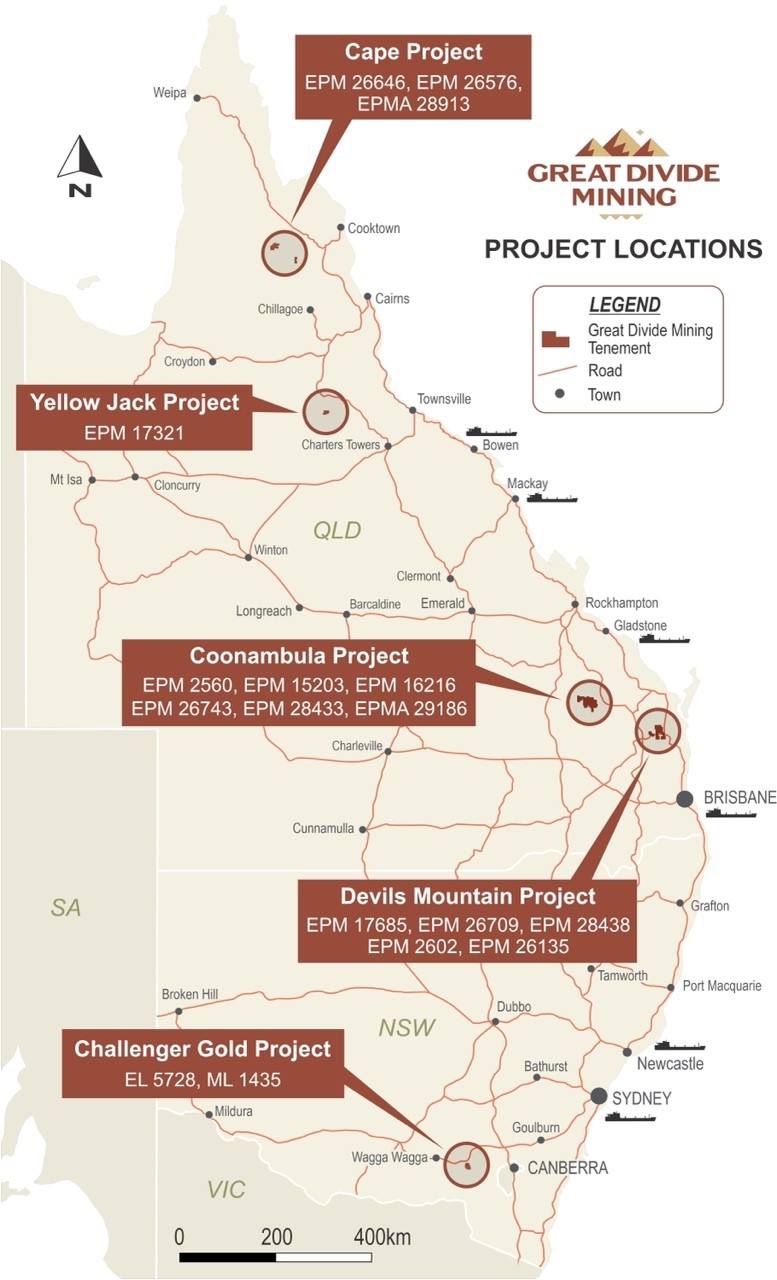

GDM also advanced early-stage planning at the Yellow Jack Project, where resources remain prospective pending processing solution finalisation, and confirmed the strong lithium and rare earths potential at the Cape Project.

Investor confidence was confirmed by two oversubscribed capital raisings, including a $2.05 million placement and $1.335 million convertible loan note facility post year-end. The Company closed the year with significant cash at bank and net assets of $4.54 million.

“FY25 was a year of delivery”, said Justin Haines, CEO , “We advanced across all projects – from exploration success at Devils Mountain and Coonambula to pouring first gold at Challenger.”

“With strong investor backing and a solid cash position, GDM is well placed to build momentum into FY26,” smiles Haines.

For further information:

Justin Haines, CEO

e justin.haines@greatdividemining.com.au

m +61 (0)418 876 420

Great Divide Mining Ltd (ASX: GDM)

Great Divide Mining is an Australian Gold, Antimony and critical metals miner, explorer and developer with five projects across 17 tenements (including two in application). GDM’s focus is on operating producing assets within areas of historical mining and past exploration with nearby infrastructure, thus enabling rapid development. Through a staged exploration and development programme, GDM intends to generate cash flow from its initial projects to support further exploration across its portfolio of highly prospective tenements.